The New York regulator approves the StableCoin of the Winklevoss brothers | Gemini dollar

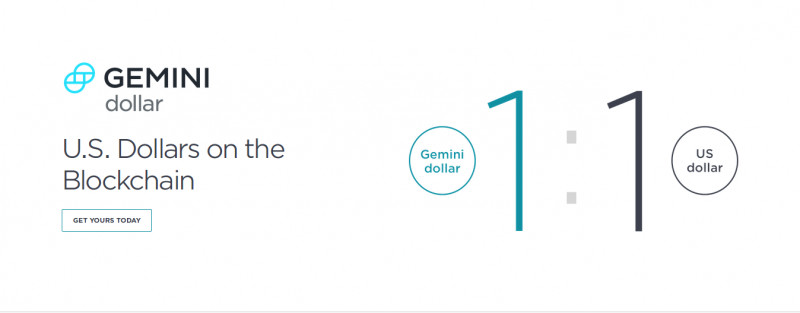

The Gemini dollar — the world’s first regulated stablecoin cryptocurrency — combines the creditworthiness and price stability of the U.S. dollar with blockchain technology and the oversight of U.S. regulators.

The New York regulator approves the StableCoin of the Winklevoss brothers based on US Dollars | Gemini dollar

The New York Stock Exchange - Gemini Trust Co. announced on Monday that they had just launched their own stablecoin cryptocurrency – Gemini Dollar.

Gemini Dollar, which will be based on the US dollar in the 1: 1 scale, will become the world's first regulated stablecoin and aims to enable users to send and receive US dollars in the ethereum network using ERC20 tokens. "Gemini Dollar - the world's first regulated stablecoin - combines creditworthiness and stability of US dollar prices with blockchain technology and supervision of the New York Department of Financial Services (NYDFS)" - such information can be read on the Gemini blog.

Stablecoiny (Stable Cryptocurrencies) are becoming more and more popular among blockchain technology well-wishers, because they supplement some of the cryptocurrency defects, including trust and instability.

"The Gemini Dollar is part of our mission to build the future of money," said one of the Winklevoss brothers.

"It is the missing link between the traditional banking system and the economy of cryptocurrencies."

In a press release, New York DFS, Maria T. Vullo, said:

„As the financial technology marketplace continues to evolve, New York is committed to fostering innovation while ensuring responsible growth. These approvals demonstrate that companies can create change and strong standards of compliance within a strong state regulatory framework that safeguards regulated entities and protects consumers.”

DFS also adds that it has set rules, to which the company will have to adapt: maintain standards in the field of anti-money laundering, anti-fraud and of course, must provide adequate measures to protect consumers.

The US dollars will be deposited at State Street Bank, and the balance would be audited every month by BPM Accounting and Consulting.

“We wanted to create a network of trust around the stablecoin,” said one of the Winklevoss brothers. “All three [Gemini, State Street and BPM] have regulatory oversight.”

This news came a month after the Securities and Exchange Commission rejected the offer of Tyler Winklevoss and his twin brother Cameron Winklevoss on an ETF based on Bitcoin.